Trump Takes Aim at Powell: What It Means for the Federal Reserve and Investors

This week, there’s a new geopolitical risk rattling Wall Street – and it has nothing to do with tariffs, the trade war, or AI. Instead, what’s now brewing is a battle between U.S. President Donald Trump and Federal Reserve Board Chair Jerome Powell…

Yes, you read that right. The president has set his sights on the head of our nation’s central bank. Now the biggest threat to the market is an old-fashioned political boxing match – social-media-style.

Welcome to Round One of the Trump vs. Powell saga. So far, the crowd isn’t loving it.

After Trump called Powell a “major loser” on social media yesterday (more on that later), both the S&P 500 and Nasdaq dropped more than 3% in a risk-off panic.

This isn’t your standard economic hiccup. This is an institutional nervous breakdown – because at its core, what’s shaking the market is a simple, uncomfortable question:

Can the Fed still be trusted to stay independent?

Trump vs. Powell: How the Federal Reserve Clash Escalated

The long and short of this latest drama is that Trump wants Powell to cut interest rates… badly.

With trade negotiations dragging and consumer prices sticky, Trump is eager to stimulate the economy ahead of 2026. Lower rates, more growth, happier voters.

But Powell isn’t biting – yet. In public remarks last week, he said the Fed is in no rush to cut rates. Why? Because of reinflation risks from Trump’s own tariffs. A trade war, after all, tends to raise prices, not lower them. Cutting rates into rising prices is a dangerous game, and the Fed knows that.

Trump’s response? A full-throttle public takedown of Powell. On social media, he’s labeled Powell “too late,” “a major loser,” and “a disaster.” Over the weekend, White House economic advisor Kevin Hassett even said Trump is looking into whether he can fire Powell outright.

As a result, the market mayhem continues.

Why Federal Reserve Independence Matters More Than Ever

The Federal Reserve is designed to be independent for a reason. It’s the foundation of U.S. economic credibility.

We don’t want politicians printing money whenever it helps them win an election. We want the Fed to make rational, apolitical decisions about interest rates and money supply.

That’s why this feud is so upsetting to Wall Street. If Trump actually removes Powell or forces him to cut rates for political gain, it would shatter a sacred norm – and inject instability into the system. If markets can’t trust the Fed, then who can they trust?

This isn’t some theoretical fear. In fact, we’ve seen this play out before… And it didn’t end well.

Nixon vs. the Fed: A Warning Sign for Today’s Market

The only modern precedent here is Richard Nixon’s pressure campaign on then-Fed Chair Arthur Burns in the early 1970s.

Back then, the economy was shaky, and inflation was already high. But eyeing reelection in 1972, Nixon didn’t care. He wanted the economy juiced – and fast – so he bullied Burns into cutting interest rates. Eventually, Burns gave in.

To hide the inflation that would inevitably result from those cuts, Nixon imposed price controls – locking in wages, rents, and consumer prices across the board. It worked temporarily. Inflation dipped, the economy boomed, and Nixon won reelection in a landslide.

But it was a con.

Underneath the surface, inflation was building; suppressed, but not solved. And when the Fed stopped cutting and Nixon ended the price controls, it all blew sky-high.

What followed was a decade-long economic disaster: runaway inflation, stagnant growth, surging unemployment, and collapsing stock prices. The 1970s were a painful decade, and it all started with a president strong-arming the Fed into rate cuts at the wrong time.

That’s the specter haunting investors today.

Could Trump repeat Nixon’s mistake?

Only if words turn into actions.

If Trump actually fires Powell – or installs a loyalist to cut rates rapidly and preemptively – we could absolutely end up reliving a version of the 1970s. We’d get short-term sugar highs, followed by long-term stagflation hangovers… a quick burst of growth followed by years of pain.

That’s why markets are panicking. The risk is real.

But we don’t think it’s going to happen like that.

Trump’s Pressure on Powell: Real Threat or Political Theater?

We don’t think Trump is trying to destroy the Fed’s independence. Instead, we see him trying to guarantee that Powell sticks to a path the Fed was already on: cutting rates by this summer.

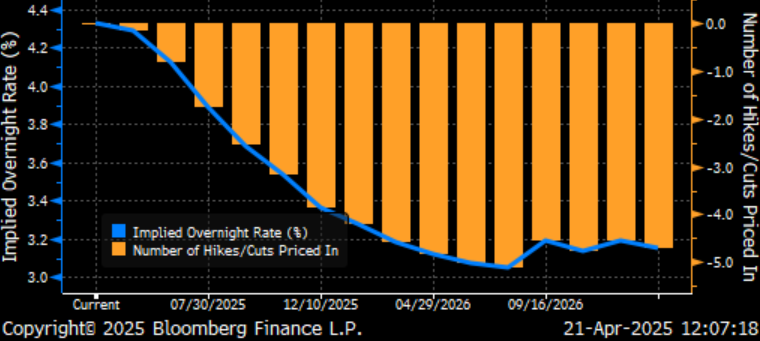

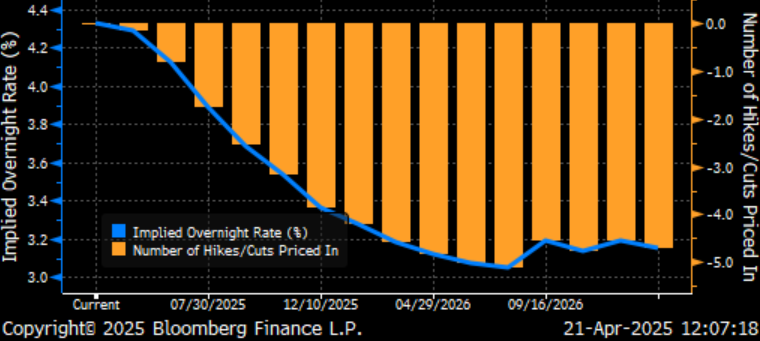

Wall Street is still pricing in four rate cuts in 2025, with the first expected by June. That expectation has remained unchanged even before Trump began his barrage.

The Fed knows that higher tariffs are slowing demand, that core inflation is easing, and that financial conditions are tightening.

In other words, the data was already pointing to rate cuts.

Trump’s tantrums, while loud and theatrical, aren’t changing the game. They’re just turning up the volume on what the Fed was going to do anyway. This is not Nixon 2.0. It’s just classic Trump – tweet now, take credit later.

How the Federal Reserve Drama Could Create Buying Opportunities

If Trump doesn’t fire Powell and the Fed does cut rates this summer – both of which we believe are highly likely – then today’s market panic is tomorrow’s buying opportunity.

This selloff, driven by fear of interference that probably won’t come to be, could give way to a massive rally once the Fed starts easing.

Lower rates mean higher valuations, more liquidity – and that growth stocks, especially high-beta tech names, can fly once again.

All that’s needed is confirmation that the rate-cut cycle is starting and that the Fed remains independent. When that happens, this wounded market could roar back to life.

In other words, now is not the time to panic.

Yes, there are real risks. If Trump goes full Nixon and tries to commandeer the Fed, markets could unravel. But there’s strong reason to believe this is mostly theater – a pressure tactic, not a power grab.

We expect that cooler heads will prevail. Powell will stay. The Fed will cut. And the market will recover.

So, be patient. Stay sharp. Look for buying opportunities amid the chaos. As the old Buffett line goes: Be greedy when others are fearful.

There’s certainly ample fear right now – which means opportunity abounds.

And AI 2.0 stocks may be the best bet.

We’re talking AI that can respond to real-world environments; embodied intelligence that can see, hear, walk, talk, lift, carry, organize, fix, learn…

Indeed, there’s a reason why every tech titan is suddenly obsessed with humanoid robots.

That’s where we believe the next trillion-dollar investment opportunities will be found. And we’ve found a compelling way to play that next phase of the AI Boom.

Uncover the details on our favorite AI 2.0 pick.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.