Today’s Stock Market: Another Great Depression or a Massive Overreaction?

We are living through one of the most violent stock market climates in modern history…

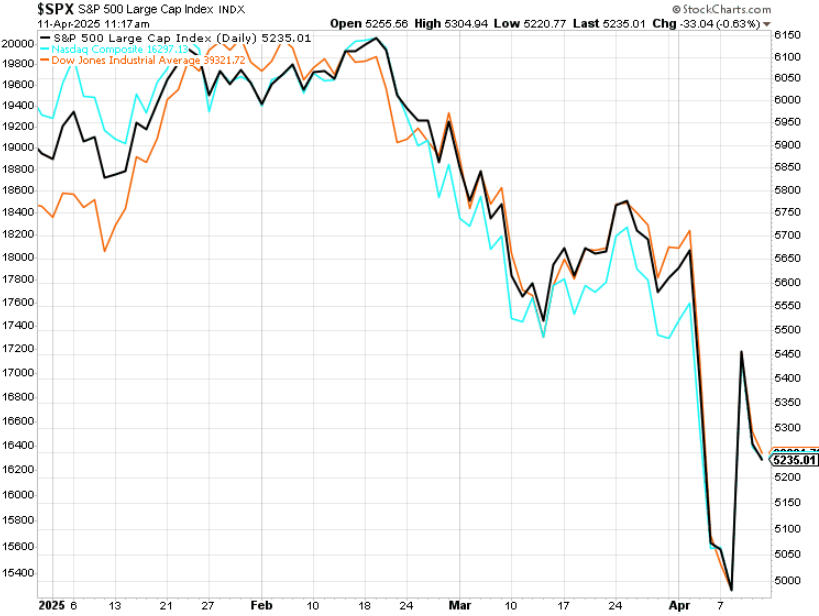

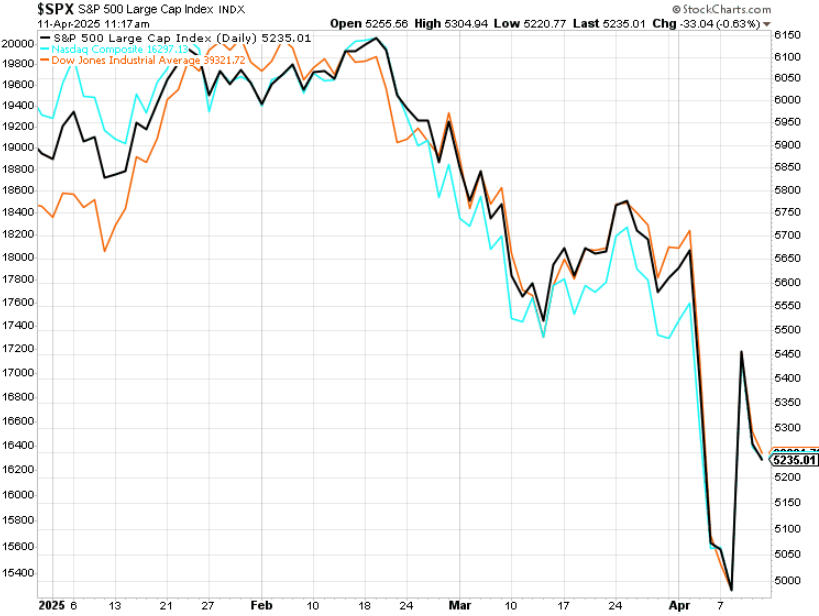

- From late February into early March, we dropped 10% in just 20 trading days – one of the fastest corrections ever recorded.

- Then, after President Trump’s “Liberation Day” tariff shock, we fell another 10% in two days; something that’s happened only a handful of times in the past 100 years.

- We followed that up with a historic 8% rally on news of a 90-day tariff pause – some of the biggest single-day gains ever…

- Only to see the market crater again the very next day, giving back more than 3.5% as traders called the pause “signal over substance.”

- Meanwhile, the volatility index (VIX) – the market’s fear gauge – has more than doubled, now hovering at levels we’ve seen only twice before in history: once during the 2008 financial crisis and once during 2020’s COVID-19 lockdowns.

This isn’t your average market pullback. This is whiplash with a capital W.

And it puts us in rare company. Historically, this kind of price action has only happened four other times – during the Great Depression, the start of World War II, 2008’s global financial crisis, and 2020’s COVID crash.

Today’s stock market mayhem is reminiscent of some major historical crashes.

But are we actually staring down the barrel of a crisis like that?

Comparing History

The market’s price action is screaming: “Brace yourself. Something catastrophic is about to happen.”

But does this look like the Great Depression? Not really.

Yes, the 1930s crash was worsened by a significant tariff package – Smoot-Hawley – that increased the average tariff rate from 13.5% to nearly 20%, triggering a global trade war. That comparison is real.

But in the ‘30s, unemployment was above 20%. Bank failures were happening on a weekly basis. Industrial production collapsed. And there was no central bank with the tools to backstop the financial system.

Today, unemployment is low, near 4%. Banks are relatively healthy. The U.S. Federal Reserve has stockpiled liquidity firepower. And the economy, though cooling, is not collapsing.

So, no, we don’t believe we’re in a tailspin toward 1930s America.

What about World War II? We don’t see that parallel, either.

Yes, global geopolitical tensions are high. The U.S.-China dynamic is fraught. The Middle East is tense, and Russia and Ukraine remain locked in conflict.

But that’s been true for a while. And while global conflict risk is real, there is no indication that we are on the verge of a world-war-scale military event.

Serious concerns, yes – but not like 1939.

How about the 2008 financial crisis?

At that time, we were dealing with a broken financial system. The banks were loaded with toxic assets. Liquidity evaporated. The entire system teetered on the edge.

But right now, there’s no Lehman, Bear Stearns, or AIG collapse. There hasn’t been a sudden disappearance of trust in overnight lending.

Instead, this is a policy-driven, market-manufactured panic.

The Stock Market Isn’t Facing a Black Swan

And that brings us to the COVID era… which, in our view, bears almost no similarities to what we’re experiencing today.

We’re not locking down economies, shutting borders, or freezing global supply chains in an instant.

We’re still working, living, and traveling.

COVID-19 was a black swan health crisis. And this is not that.

This is a classic market overreaction to a real but overstated fear – tariffs and an ensuing trade war.

Now, don’t get us wrong. These tariffs are messy and economically damaging. But they’re not catastrophic.

That is, according to Bloomberg Economics, even with every reciprocal tariff enacted, the average U.S. tariff rate tops out at ~27% (vs. 2.5% last year). Using Fed modeling, that translates to a 3.4% drag on GDP.

That’s certainly meaningful – but not apocalyptic.

By comparison, the 2008 financial crisis knocked U.S. GDP down by more than 8%. The COVID-19 crash did the same.

Even if today’s tariffs stick, we’re talking a fraction of those drops. And we don’t think they’ll be around for long.

An Important Tone Shift

Just a few days ago, President Trump announced a 90-day pause on reciprocal tariffs for all countries except China.

Now, the market didn’t love the lack of detail. And the average tariff rate didn’t drop meaningfully (it only slid from 26.85% to 26.25%, to be exact).

But that’s not the point.

In our view, what’s most important is that the tone has shifted: from escalation to negotiation.

Since the pause was revealed:

- 70 countries have reportedly reached out to the White House for trade talks

- 20 have submitted formal proposals

- Two deals are close to being finalized

- Trump said that he’s confident the U.S. will get a deal finalized with China

The tough talk is over. It’s time for true negotiations.

And we expect that once those deals are locked in, it’ll be off to the races for stocks…

A lookback to the stock market of mid-February shows why.

Indeed, before this trade war started, stocks were at all-time highs, with the S&P 500 up at 6150. Consumer sentiment was strong, with inflation trending lower, easing to 2.8% from January’s 3.0% reading. The AI Boom was accelerating. And corporate earnings were stabilizing; S&P corporate earnings showed year-over-year growth of 17.8% – the highest since Q4 2021.

This wasn’t a stock market on the brink of collapse. It was a market in mid-cycle expansion.

Tariffs clouded that picture. But if we clear the fog – and we believe we’re in the process of doing so – the original bullish thesis comes right back into focus.

And that’s the opportunity here.

The Final Word on Today’s Stock Market

Look; we don’t think we’ve bottomed yet. The stock market is still fragile, with extreme volatility.

But that doesn’t mean you wait forever to nail the bottom. You just have to give yourself enough time.

If you’re investing with a 12-month time horizon, we think buying stocks today will look smart.

Not tomorrow, next week, or even next month… But we think that a year from now, when the smoke has cleared, the trade deals are done, and the AI boom continues to gain steam, stocks will be much higher.

That’s why we’re advocating for a measured reentry strategy:

- Nibble on dips

- Focus on quality

- Buy high-conviction names

- Stay patient

This is how you win in volatile markets.

Let me leave you with this…

This isn’t 1930, 2008, or 2020.

This is 2025. And while the headlines are scary and the price action is violent, the fundamentals are not screaming “collapse.”

They’re saying: “This is bad. But it’s survivable.”

The trade war will pass as tariffs are negotiated. The Fed will likely cut. And the long-term stock market drivers – AI, innovation, productivity – are still in play.

Don’t get shaken out by short-term panic.

If you have time on your side, this is a moment to be greedy when others are fearful, as Warren Buffett says.

We’re not trying to catch the knife. We’re trying to ride the rebound.

Once this storm clears, the sun’s going to shine very bright.

And when it is time to buy the dip, AI 2.0 stocks may be the best bet.

We’re talking AI that can respond to real-world environments; embodied intelligence that can see, hear, walk, talk, lift, carry, organize, fix, learn…

Indeed, there’s a reason why every tech titan is suddenly obsessed with humanoid robots.

That’s where we believe the next trillion-dollar investment opportunities will be found. And we’ve found a compelling way to play that next phase of the AI Boom.

Uncover the details on our favorite AI 2.0 pick.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.