Historic U.S.-China Trade Deal Could Spark a 2025 Stock Market Boom

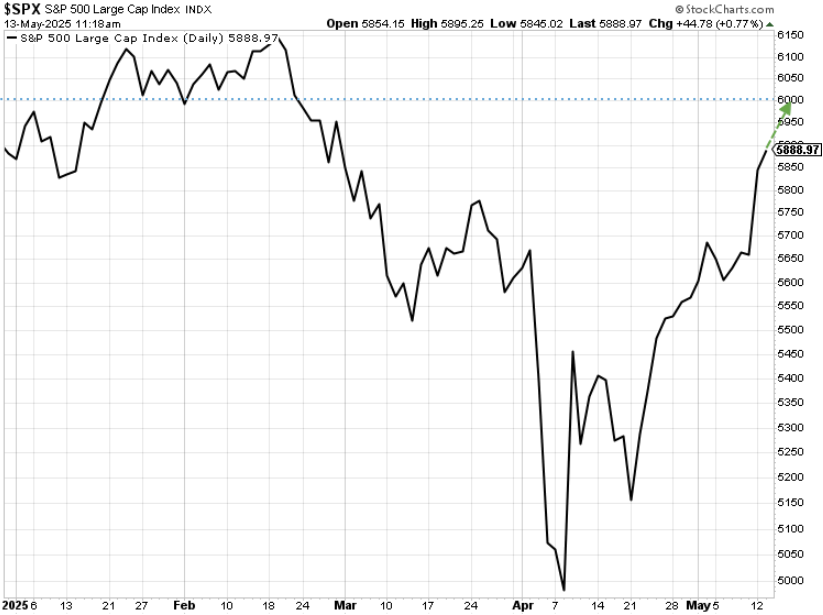

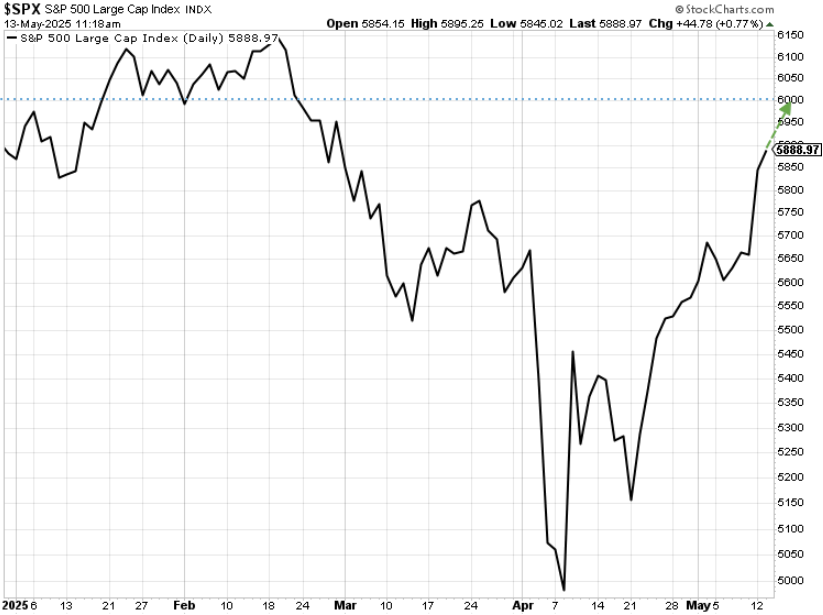

Yesterday wasn’t just another good day for the stock market. It was a turning point; a declaration that the worst of the trade war may finally be over. After weeks of tariff escalation and market volatility, the United States and China have struck a massive trade deal… and the stock market responded like a coiled spring.

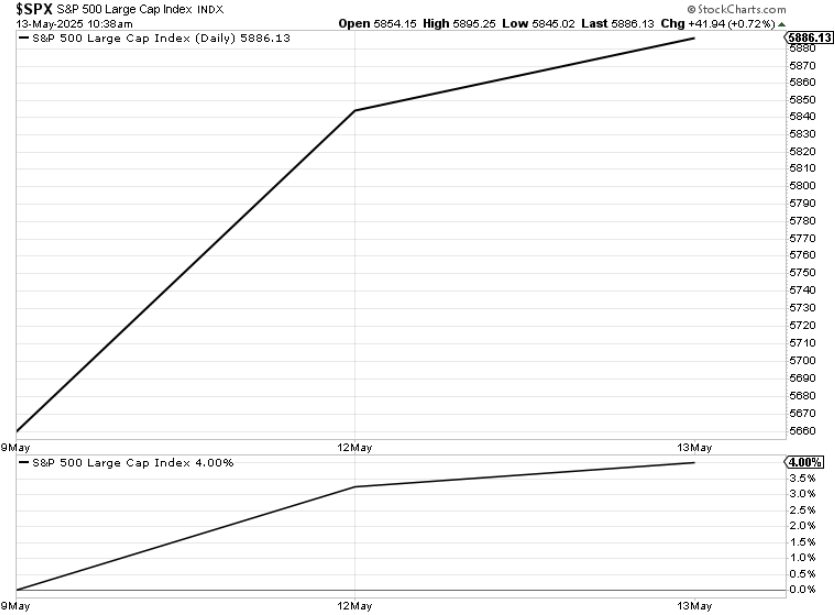

The S&P 500 roared higher to reclaim all of its post-Liberation Day losses. Between Friday May 9’s close and this morning’s open, the index has risen about 4%.

But this isn’t just about a rebound.

In our view, this truce reflects a full-blown ceasefire. And it just set the stage for a summer rally that could be legendary, especially in one of the most beaten-down – and now best-positioned – corners of the market: high-quality AI infrastructure stocks.

What the New U.S.-China Trade Deal Means for Markets

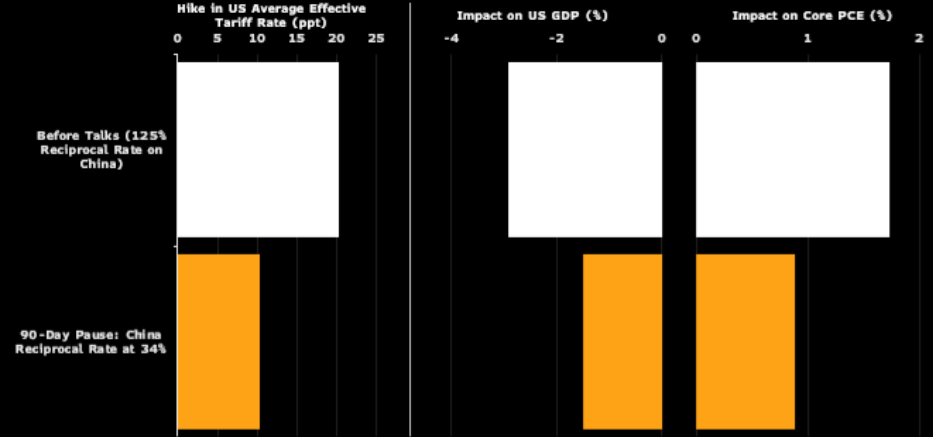

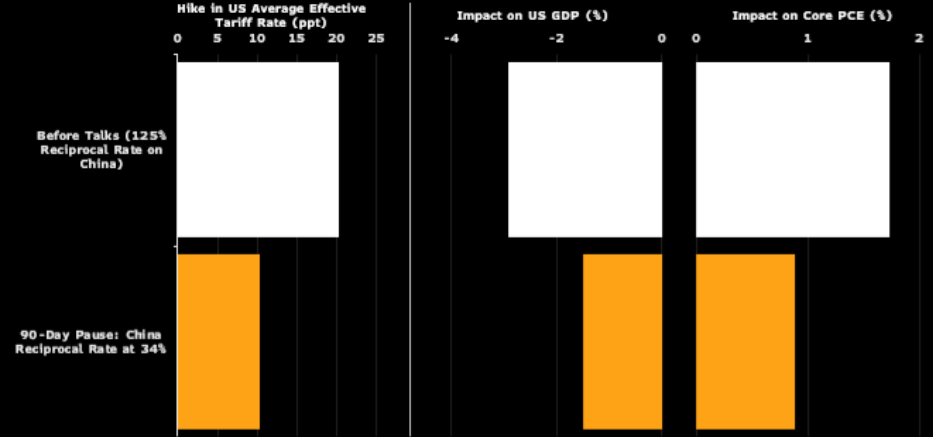

For weeks, investors were bracing for a full-scale economic decoupling between the world’s two largest economies. Tariff rates were ratcheting higher. U.S. companies were scrambling to reroute supply chains. Wall Street was staring down the barrel of a 125% reciprocal tariff rate on Chinese imports: a tax so punitive it threatened to choke off U.S.-China trade flows altogether.

And then yesterday’s news hit.

As CNN reported, “each side has agreed to lower ‘reciprocal’ tariffs on the other by 115 percentage points for 90 days.” In other words, the U.S. tariff rate on Chinese imports is set to fall from 125% to 10%.

That’s not a typo. That’s a collapse in tariffs so dramatic, it’s hard to overstate. It takes us from a level of trade apocalypse to something resembling… sanity… even normalcy.

Further, because China is such a large trading partner for America, the massive reduction in that reciprocal rate alone was enough to plunge the average effective U.S. tariff rate on all imports from 23% to just 13%.

Yes, that’s still above the 3% pre-trade-war baseline from 2024. But it’s miles away from the crisis-level 30% rate we saw just weeks ago. And it’s only slightly higher than the White House’s new 10% “global minimum” tariff, which now appears to be a long-term policy anchor.

That leads us to believe that the worst of the trade war is not just behind us – it’s buried. And markets are finally free to price in the future again.

Why Lower Tariffs Could Spark an Economic Boom

Tariffs are a tax, plain and simple. And like any tax, they slow the economy.

Indeed, the Federal Reserve estimates that every one-point rise in the average U.S. tariff rate drags on GDP by about 0.14%.

So, when tariffs were at 30%, that implied a 3.8% drag on GDP – enough to totally negate any positive effects from tax cuts, deregulation, or even rate cuts. It was like trying to sprint with a ball and chain.

But with tariffs now down to 13%, the drag is just 1.4%. That’s much more manageable. And with fresh tax cuts and deregulation policies also gaining steam – and rate cuts coming this year – the economy is looking at enough growth firepower over the next few months to largely (if not entirely) offset a 1.4% tariff-induced drag.

Which means investors can stop fearing recession headlines and start focusing on what actually drives markets: earnings, innovation, and growth.

How the Trade Deal Should Revive AI Infrastructure Stocks

With macro headwinds dissipating, the next few months should see the stock market normalize – meaning it should go right back to where it was before this whole trade war saga blew up.

That implies another 5% upside for the S&P by mid-summer.

But the story doesn’t stop there.

Because if the index is looking at a 5% gain, AI infrastructure stocks could be staring down something closer to 50%… maybe even 100%.

These companies – chipmakers, data center builders, optics specialists, memory giants – have been on the bleeding edge of the AI revolution. They’re building the backbone of artificial intelligence: the hardware, the silicon, the cables, the energy solutions.

But they’ve also been among the most vulnerable to trade tension.

Why? Because their supply chains, their customers, and their growth are global. And nothing crushes global exposure like a trade war between the U.S. and China.

Now the fog of war is lifting – and these stocks are ready to soar.

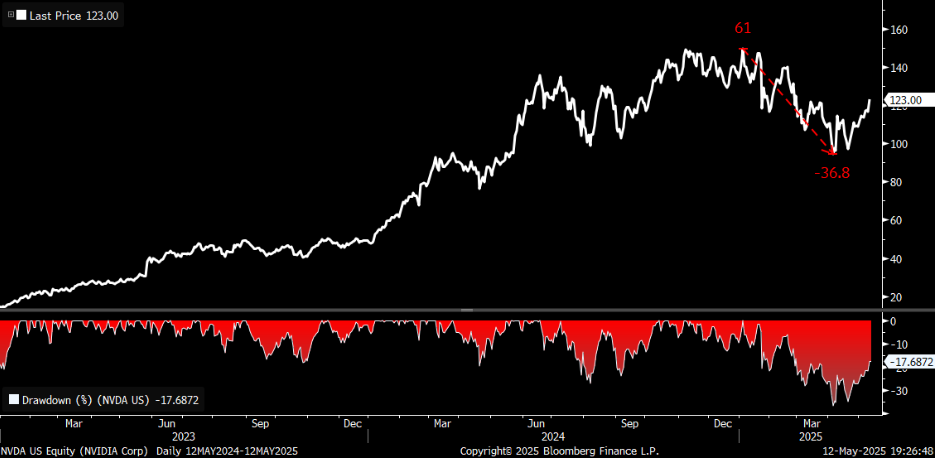

Take Nvidia (NVDA), the king of AI chips. The stock peaked at $150 before “Liberation Day.” Then came the tariffs, and the stock cratered. Even after yesterday’s rally, it’s still 25% below its peak.

That’s a gift.

Because if economic normalization is truly here – and trade headwinds are, in fact, easing – stocks like Nvidia aren’t just going back to their highs. They’ll rise through them.

And, of course, it’s not just Nvidia. We’re seeing similar setups in Broadcom (AVGO), Marvell (MRVL), Super Micro (SMCI), Arista Networks (ANET), even Micron (MU) and Applied Materials (AMAT). Many of these names are still 30% to 50% below their springtime peaks.

That’s a huge gap – and one that a few strong weeks of bullish sentiment could very easily close.

Stocks Poised to Soar as Trade Tensions Ease

Let’s be clear: this isn’t about blindly buying every AI stock and hoping for a moonshot.

This is about timing and positioning.

Over the past two months, high-quality AI infrastructure names were hit not because their businesses deteriorated but because of macro headwinds. Those are now vanishing.

The AI boom is still intact. Spending is still accelerating. Data centers are still being built. Chips are still in high demand. And the world’s top companies – from Microsoft (MSFT) to Meta (META) to Amazon (AMZN) – are still throwing billions into next-gen infrastructure.

Now with tariffs falling and trade flowing again, these companies can breathe… and so can their stocks.

That’s why we believe the real rally starts now.

The first wave was the market recovering its post-Liberation Day losses, which it has done over the past month.

We expect that the second wave will be a sharp rotation into trade-sensitive, secular-growth sectors.

And the final wave? A full-blown meltup in AI infrastructure stocks as investors race to price in the next leg of the AI super-cycle, free from the shadow of global trade tensions.

Final Word: The Trade Deal That Could Launch a New AI Supercycle

If this feels familiar, that’s because it is.

Back in 1998, markets were deep into the Dot Com Boom. But fears of global contagion (remember the Asian financial crisis and Russian default?) spooked investors. The Nasdaq pulled back. Stocks wobbled.

Then came rate cuts and a return to stability; a clearing of the macro clouds.

What happened next? The Nasdaq didn’t just recover. It exploded, more than doubling in 1999 for its best year ever.

We think we’re at a similar inflection point now.

The AI boom isn’t over. It’s pausing, consolidating… coiling.

And now with today’s macro headwinds gone and the trade war fading, it’s ready to blast off again.

Yesterday’s U.S.-China truce wasn’t the end of the story. It was the start of a new chapter.

Get ready.

We think a new form of AI – something we call AI 2.0 – will steal the rally spotlight and take Wall Street by storm.

We’re talking about intelligent systems that can navigate the real world: machines that see, hear, move, speak, adapt, and even solve problems on the fly.

It’s no coincidence that the biggest names in tech are racing to develop these humanoid robots.

This is where we see the next wave of trillion-dollar opportunities taking shape – and we’ve identified a standout way to tap into this emerging phase of the AI revolution.

Get the full story on our top AI 2.0 stock pick.

Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.