A Comprehensive Guide to Subject-To Real Estate Investing

A Comprehensive Guide to Subject-To Real Estate Investing

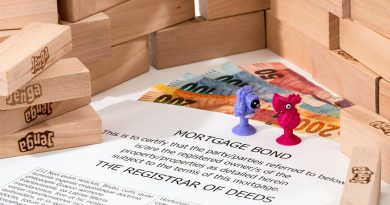

Real estate investing can be a lucrative way to build wealth and generate passive income. One strategy that is gaining popularity among investors is subject-to real estate investing. This method involves purchasing a property “subject to” the existing mortgage, meaning the buyer takes over the payments without actually assuming the loan.

In this comprehensive guide, we will cover the basics of subject-to real estate investing, including how it works, the benefits and risks involved, and how you can effectively implement this strategy to grow your real estate portfolio.

What is Subject-To Real Estate Investing?

Subject-to real estate investing involves purchasing a property while leaving the existing mortgage in place. This means that the investor takes over the loan payments, but the original homeowner remains responsible for the mortgage. The investor gains control of the property and can benefit from any cash flow or appreciation, without having to qualify for a new loan.

How Does Subject-To Real Estate Investing Work?

When a property is purchased subject-to, the buyer and seller enter into a contractual agreement that allows the buyer to take over the existing mortgage. The buyer typically pays the seller an upfront fee or agrees to make the mortgage payments on their behalf.

The title of the property is transferred to the buyer, even though the original homeowner’s name remains on the mortgage. The buyer then becomes responsible for making timely mortgage payments, property taxes, and insurance premiums.

Benefits of Subject-To Real Estate Investing

There are several benefits to investing in real estate subject-to. Some of the key advantages include:

1. No need for new financing: Since the existing mortgage remains in place, the investor does not need to qualify for a new loan. This can be particularly beneficial for investors with less-than-perfect credit or those looking to avoid the lengthy approval process.

2. Lower upfront costs: By purchasing a property subject-to, investors can acquire real estate with minimal cash outlay. This can provide a higher return on investment and improve cash flow.

3. Cash flow potential: Subject-to properties can generate positive cash flow if they are rented out or sold for a profit. This can provide passive income and build wealth over time.

4. Portfolio diversification: Subject-to investing allows investors to add properties to their portfolio without tying up a significant amount of capital. This can help diversify risk and increase overall returns.

Risks of Subject-To Real Estate Investing

While subject-to real estate investing can offer many benefits, there are also risks to consider. Some potential drawbacks include:

1. Violation of due-on-sale clause: Most mortgages include a due-on-sale clause, which gives the lender the right to demand full repayment if the property is sold or transferred. Purchasing a property subject-to could trigger this clause, potentially leading to foreclosure.

2. Seller default: If the original homeowner fails to make mortgage payments, the property could go into foreclosure. The investor would then be responsible for bringing the loan current or risk losing the property.

3. Limited exit strategies: Subject-to properties may have restrictions on how they can be sold or refinanced, which could limit the investor’s ability to exit the deal or access additional funds.

Implementing Subject-To Real Estate Investing

To effectively implement subject-to real estate investing, investors should follow these steps:

1. Research the market: Conduct thorough market research to identify properties that meet your investment criteria and have potential for positive cash flow or appreciation.

2. Identify motivated sellers: Look for sellers who are motivated to sell quickly and may be open to creative financing options like subject-to investing.

3. Perform due diligence: Evaluate the property’s condition, rental potential, and financials to ensure it aligns with your investment goals.

4. Negotiate terms: Work with the seller to negotiate a subject-to agreement that is mutually beneficial and protects your interests.

5. Close the deal: Complete the necessary paperwork to transfer the title and take over the mortgage payments.

Conclusion

Subject-to real estate investing can be a valuable strategy for investors looking to acquire properties with minimal upfront costs and generate passive income. By understanding how subject-to investing works, its benefits and risks, and how to effectively implement this strategy, investors can grow their real estate portfolio and build long-term wealth. As with any investment, it is important to conduct thorough due diligence and seek advice from a qualified real estate professional before engaging in subject-to transactions.